28 Mar 2012

Led by Asians, Global Rich Get Richer But Fear Income Inequality Backlash – Wealth Report

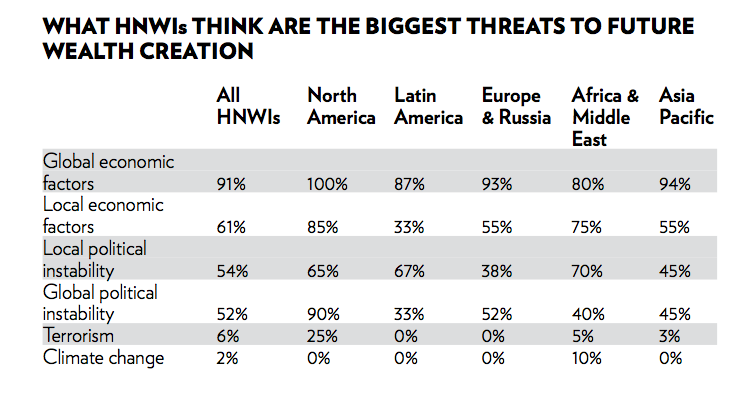

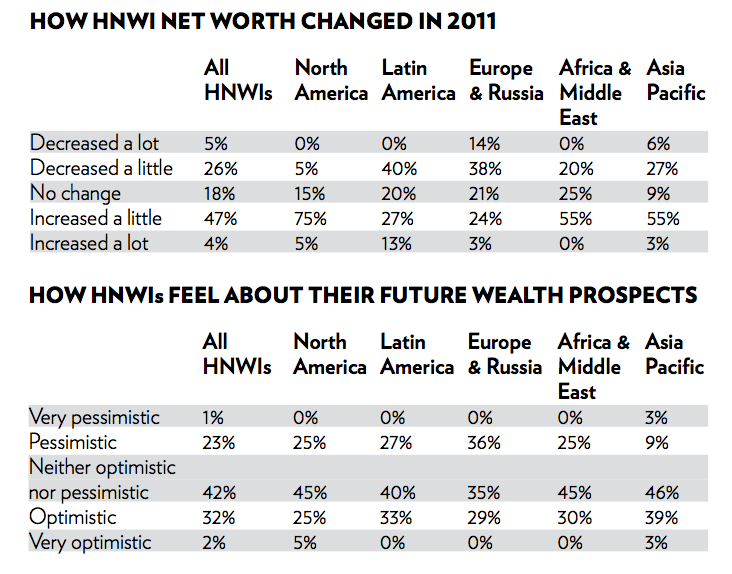

London, 28 March 2012 — Most of the world’s richest people became even more rich in 2011 and are optimistic about getting still richer in future. However, 91% of them see “global economic factors” as the biggest threat to future wealth creation, as against a fractional 6% who see “terrorism” as the biggest threat and a mere 2% who cite “climate change.” There are also clear signs they are getting worried about the social and political ramifications of growing global income inequality.

Source: The Wealth Report 2012

These responses (see accompanying tables) are reflected in the 2012 edition of The Wealth Report, launched today by Knight Frank and Citi Private Bank. Designed to offer what it describes as “a unique and global perspective on the world of prime property and wealth”, the report includes pricing data for 71 of the world’s most desirable residential locations, as well as insight from property and investment experts at Knight Frank and Citi Private Bank. One of its highlights is an Attitudes Survey, which represents the thinking of almost 5,000 (U)HNWI clients of Citi Private Bank.

The report says that the total net worth of the “centa-millionaires” was $39.9 trillion in 2011. A “centa-millionaire” is an individual with more than US$100 million in disposable assets. The report says there were 63,000 such individuals in 2011 and will grow to 86,000 by 2016. Most of the growth will come in HNWI individuals in China, India, Hong Kong and Singapore. The number of centa-millionaires in South and Central Asia is expected to double from 3,000 to 6,000 and in Southeast Asia, it will rise from 18,000 to 26,000. Even Africa is expected to double the number of centa-millionaires from 1,000 to 2,000 in the same period, the Wealth Report says.

Source: The Wealth Report 2012

Liam Bailey, Head of Residential Research, Knight Frank, writes in the introduction, “Never before have wealth creation, economic risk and politics been so closely intertwined with the performance of prime residential and commercial property markets.”

He adds, “The central trend dominating prime property markets has been the relentless growth of “plutonomy” economics, a phenomenon that sees the wealth of the richest 1% growing far quicker than that of the general population – a trend we initially examined in our first Wealth Report in 2007. A year later, in the eye of the global economic storm, plutonomy seemed under threat as asset values plummeted. Ironically the response to the financial crisis did more to revive the value of investments held by the wealthy than improve the position of the wider population.”

However, this year’s report contains an article highlighting the growing political concerns about the potential effects of income inequality.

It quotes Tina Fordham, Senior Global Political Analyst at Citi, as warning that the dissatisfaction with income inequality already being manifested in the Occupy Wall Street demonstrations will gain momentum, and that there could be a long-term recalibration between governments, businesses and society as a result. “It could take a decade or longer for the ‘new normal’ to emerge,” she says.

The report notes that at this year’s World Economic Forum in Davos, income inequality was among the issues at the top of the list of countries’ current concerns, leapfrogging environmental issues, which dominated the global agenda for many years before the financial crisis struck.

Willem Buiter, Citi’s Chief Economist agrees, warning that the political backlash against income inequality, both in advanced and emerging economies, could strengthen. “Governments may use more taxation instruments and globally there may be a further attack on tax havens. Recent governmental and intergovernmental activity in these areas is not a passing phase,” he says. “It’s going to be a tougher playing field for the rich.”

Key findings of The Wealth Report 2012 are as follows:

- London, New York, Hong Kong and Paris are seen as the most important world cities for high-net-worth individuals (HNWIs).

- Beijing and Shanghai are the cities with the most rapid growth in importance to HNWIs.

- HNWIs from the Middle East and Africa rate Dubai as the location with the most rapid growth in importance, with HNWIs from Latin America rating Miami and Sao Paolo as strong contenders for future influence.

- Personal security (63%) now ranks above economic openness (60%) in HNWIs’ choice of cities to live.

- Monaco remains the most expensive residential location in the world, with one square metre there now worth $58,300 (Q4 2011), followed by the prime locations in Cap Ferrat, London and Hong Kong.

- The region covering China, SE Asia and Japan now has more centa-millionaires (those with over US$100m in assets) than North America or Western Europe.

- Wealth flows from developing economies underpinned prices across the leading prime markets in North America and Europe including Miami, Vancouver and London in 2011.

- Knight Frank and Citi Private Bank expect further growth in interest in commercial property from HNWIs, forecasting US$74.1bn of private transactions globally in 2012 (a 5% year-on-year increase).

- The newly wealthy from the world’s fastest-growing emerging economies rate stability, business transparency and education systems as the most important factors in a global city; prices of luxury housing in locations with this magic formula have been underpinned by their interest.

- In Europe, despite the past year’s continental recession, the main luxury market hotspots have remained relatively hot – eight out of 10 top locations in the Knight Frank Prime International Residential Index (PIRI) price rankings are in the UK, France or Switzerland.

- Prime property is a key part of portfolios – 2011 saw a global increase in allocation to real estate of 19%; the largest climbers in 2011 popularity for investment were bonds (+65%) and cash (+60%).

- Lifestyle and investment remain the key drivers for luxury second-home purchases, with 16% of all HNWIs surveyed already owning a ski chalet, and 40% a beachfront property. The US and UK are the top second-home destinations for the rich.

Andrew Shirley, editor of The Wealth Report comments: “This year’s Wealth Report contains even more evidence that the world’s wealthy are weathering the economic slowdown better than the wider population, and nowhere is this better reflected than in prime property markets. Those markets considered ‘safe-haven’ locations continue to attract private investors looking for both prime residential and commercial property. Political and economic uncertainty across the world is only helping to exacerbate the trend.”

“But it is not just property where HNWIs from fast-growing economies are making their mark. The Wealth Report’s Attitudes Survey reveals that they are playing an increasingly important role in the worlds of sport, fine art, wine, and philanthropy.”

Luigi Pigorini, CEO Citi Private Bank Europe, Middle East & Africa comments: “Wealthy individuals and families, especially those originating from Europe, the Middle East, Africa and Asia, have become extraordinarily global in nature. Many seek the rule of law and stability that make the UK a top choice for investment. With English a popular second language and a relatively weak pound, the global wealthy have confidently focused their interest on London and the wealth preservation it can afford.

“Investors seeking a more conservative strategy have gravitated toward high-quality properties in central business districts in cities such as Beijing, London, Munich, New York, Paris and Sydney. Conversely, for those willing to accept more risk, high growth markets, such as Asia and Latin America, may be able to generate more attractive returns relative to the US and Europe. Investors must remain cautious as global economic growth will continue to influence all property markets, and investors should measure their yield and return expectations taking growth into account.”

Visit The Wealth Report 2012 site here: http://www.thewealthreport.net