27 Mar, 2013

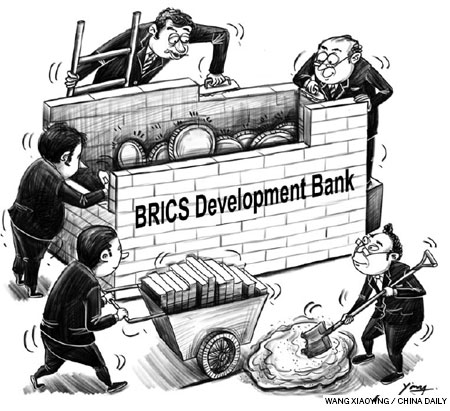

Planned BRICS bank holds promise

Beijing 2013-03-26 – The feasibility of establishing a development bank and currency reserve is expected to be hot topics of discussion at the BRICS summit in Durban, South Africa, on March 26 and 27. Developmental financial cooperation has become an important issue for BRICS member states, especially for Brazil, Russia, India and South Africa, because they need an economic impetus to overcome their infrastructural bottlenecks to ensure sustainable development.

China Development Bank is expected to serve as a model for the proposed “BRICS Development Bank”. The discussion is likely to focus on infrastructure construction and financing for basic industries, because inadequate or poor infrastructure has been hampering the economic and social development of many developing countries and regions, including some BRICS member states.

Inadequate or poor infrastructure will hinder the economic and social development of developing countries and regions because it reduces efficiency, and creates an imbalance in regional development and income distribution.

According to World Bank statistics, the power outage caused a loss of 6.6 percent in sales in India in 2006, while the figure was 1.3 percent in China in 2003. Ports in Brazil are known for delays in the international trade circle, and the cost of importing a goods container from Brazil is double that of China and 1.5 times that of India. Poor infrastructure can also be blamed for Brazil’s falling annual economic growth rate – from 7.5 percent in 2010 to 2.7 percent in 2011 and less than 1 percent in 2012. Of course, external factors like the global financial crisis and fluctuating foreign exchange rates are also to blame for the drop.

Therefore, clearing infrastructural bottlenecks has become the common goal of many emerging economies. Given the severe economic shocks and falling growth rates in emerging economies since the latter half of 2011, large-scale investment in infrastructure could be used as a strong tool to stimulate demand and thus boost growth.

Former US president Franklin D. Roosevelt’s New Deal and China’s large-scale investment in infrastructure during the Asian financial crisis not only helped them sustain their economies in the short term, but also paved the way for development in the long run. In fact, China embarked on a new round of large-scale investment in infrastructure last year to offset the impact of a struggling world economy and a decelerating domestic market.

Emerging markets, one after another, have announced major infrastructure construction projects since last year. For example, Brazilian President Dilma Rousseff announced a $65-billion investment plan for the transport sector on Aug 15. The plan is aimed at extending Brazil’s railway lines by 10,000 km, with trains running at 100-150 km an hour, and highways by 7,500 km. The improved transport network will help Brazil reduce considerably the cost of transporting goods within and from the country.

It is true that it’s not possible for emerging economies to implement a New Deal-like plan or replicate China’s successful programs to combat the Asian financial crisis. But many emerging economies’ plans for developing infrastructure and high technologies sound impractical because of limited inputs and hasty timetables. Take for instance Brazil’s decision to invest $65 billion to improve its infrastructure. The amount is hardly enough to add 10,000 km of railway lines and extend its highways by 7,500 km, that is, if the additional infrastructure is not franchised.

Besides, weak fiscal capability of an economy can create trouble for infrastructure projects. In 2007, the then Lula da Silva government in Brazil announced that it would invest 1.2 billion Brazilian real ($600 million) to build new roads. But as late as February 2012, the government had raised only a fraction of the amount.

It is in overcoming such fiscal difficulties that the proposed “BRICS Development Bank” and currency reserve can play a very important role. For China, which has excellent infrastructure, a BRICS bank will open avenues to invest in large-scale infrastructure projects in emerging markets, further stimulate the export of its goods and equipment and import of raw materials.

As the world’s second largest economy, China is no longer only a participant in the world market. Now, it also has the capability to stabilize its external demand by helping adjust and stabilize the economies of its trading partners.

Moreover, a currency reserve will help stabilize the currencies of Brazil, Russia, India and South Africa. This is important because rising economic risks in emerging markets could lead to a currency and financial crisis.

The fact, however, remains that an exclusive BRICS bank and currency reserve, which could reduce or overcome the risks faced by emerging economies, is still a long way off because of the differences among the five BRICS member states.

The author is a researcher at the International Trade and Economic Cooperation Institute of the Ministry of Commerce.

Liked this article? Share it!