17 Aug 2013

Chinese millionaires report features first “Happiness Index”

Beijing, 2013-08-15 09:17 – At a time of economic slowdown combined with market uncertainties, Chinese millionaires’ confidence in the country’s economy in the next two years has dropped for a second consecutive year, according to the GroupM Knowledge-Hurun Wealth Report 2013.

The report was co-released by the media investment management firm GroupM China and the Shanghai-based Hurun Report on Wednesday.

One quarter of the millionaires surveyed said they were “very confident” in the economy in the next two years, down about 3 percentage points year-on-year. In the previous year, 54 percent of the respondents said that they were “very confident” in the economy.

|

|

|

About 9 percent of the surveyed millionaires said they are not confident in the country’s economy, 2 percentage points higher than a year earlier.

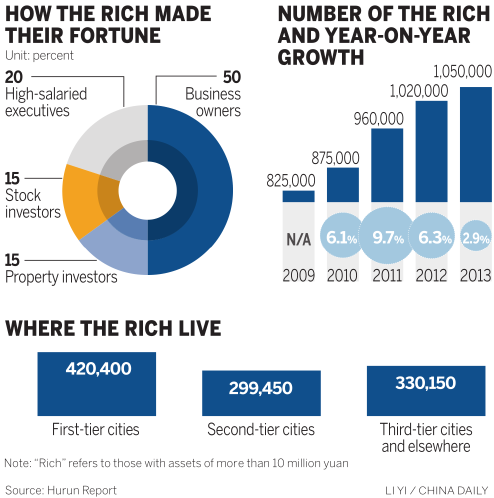

Meanwhile, the number of millionaires – those with a personal wealth of 10 million yuan ($1.63 million) or more – has increased to 1.05 million this year, 30,000 more than a year earlier. The number of the super-rich, those who have personal assets worth over 100 million yuan, has increased by 1,000 to reach 64,500.

However, the growth rates in the number of millionaires and super-rich people were the slowest ever since the Hurun Wealth Report was first published five years ago.

“Although the growth rate of China’s millionaires is the lowest in the last five years, we can still gain insights into their life choices as revealed from the changes in their consumption and investment preferences, their perception of life and health and social responsibility, despite uncertainty in the wider environment. This will help brand marketers to think deeper about what kind of value their brands could offer in their brand communication strategy,” said Eve Lo, chief knowledge officer of GroupM China.

Beijing remains home to 184,000 millionaires and 10,700 super-rich people. Guangdong – home to 172,000 millionaires and 9,600 super-rich people – dislodged Shanghai and grabbed the second slot.

Chinese millionaires mainly comprise four categories of people: private business owners, stock market gurus, property speculators and high-earning executives.

Avoiding risk is now the main investment guideline for millionaires, after the recent less-than-promising performance of the country’s stock market and property market. Only 44 percent of millionaires showed an interest in the stock market, the lowest level in three years. Real estate remains the first choice when it comes to personal investments, despite the macro-adjustment measures, accounting for 64 percent of all investments.

Following the craze for studying abroad, there is now also an increasingly clear tendency to buy overseas property, with the United States the top destination.

Huang Ying, 31, bought a house in Los Angeles last month for about $2.4 million. Her husband works in the financial industry in Shanghai, and has an annual income of about 5 million yuan.

“We have three children at present, and my eldest son is seven. Therefore, we have bought the house so that my son can go to a good primary school in that neighborhood,” said Huang.

The Millionaire Happiness Index, which featured in the report for the first time this year, showed that 73 percent of respondents said that they are happier than the previous generation. The average happiness index is at 7.8 out of 10.

“For the Chinese millionaire class, the key words this year are ‘health’ and ‘happiness’,” said Rupert Hoogewerf, chairman and chief researcher of the Hurun Report.

What millionaires want the most is good health. One quarter are dissatisfied with their health condition, and more than one-third feel that they don’t exercise enough.

“Chinese consumers have changed a lot in terms of their demand for products and their ideas for health. They have changed their focus from comprehensive nutrition supplements to customized health products,” said Cai Baoguang, general manager for Pfizer Inc’s health drugs unit in China and Hong Kong.