27 Jan, 2014

Gallup Polls: Baby Boomers Put More Money Than Trust in Banks

This article is part of an ongoing series analyzing how baby boomers — those born from 1946-1964 in the U.S. — behave differently from other generations as consumers and in the workplace. The series also explores how the aging of the baby boomer generation will affect politics and well-being.

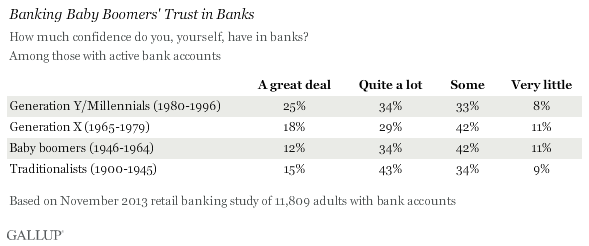

WASHINGTON, D.C. — January 21, 2014 (Gallup Polls) — Baby boomers make up the largest share of banking customers in the U.S., according to a December Gallup poll. Nearly nine in 10 baby boomers (89%) currently have at least one checking, savings, or money market account at a bank or another financial institution. But Gallup’s 2013 retail banking study shows that just 12% of baby boomers with active bank accounts trust banks a “great deal,” with the majority placing only “some” or “very little” trust in these institutions.

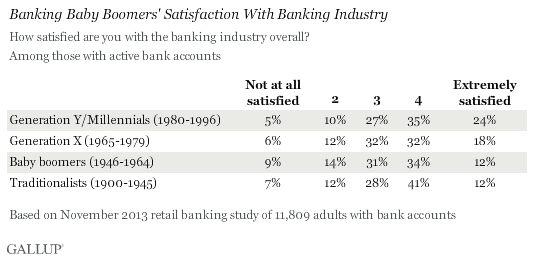

On top of this, baby-boomer bank customers are among the least satisfied of any generation with the banking industry overall; nearly one in four in this generation are dissatisfied, with 9% not satisfied at all and another 14% dissatisfied. Both of these findings are similar to what Gallup found in its 2011 and 2012 retail banking studies, suggesting banks have failed to win baby boomers’ trust or satisfy them in the past several years.

This lukewarm trust and satisfaction is not a healthy sign for the industry. Boomers are also as likely as or more likely than younger generations to be wealthy and to be business owners — two target customers for banks and their products. Twenty-nine percent of baby-boomer banking customers have more than $100,000 in investable household assets, compared with 19% of Generation X and 12% of Generation Y. Traditionalists may be the wealthiest cohort, but the 39% with this much in investable assets represents a much smaller segment of the population. Sixteen percent of boomers and 15% of Generation X report they currently own a business, while only 6% of Generation Y and 9% of traditionalists are business owners.

Majority of Baby Boomers Bank Online

One surprising area where banks may be able to engage their baby-boomer customers is in their online service options. While some banks may assume their older customers are less likely to use digital relationships for their banking needs, Gallup’s 2013 retail banking study shows that 75% of banking baby boomers used online services in the past six months. Nearly as many of these boomers (71%) use online banking services at least weekly, as frequently as Generation X (70%) and Generation Y (72%) do. This suggests that baby boomers value the speed and convenience of online banking as much as younger generations do.

Bottom Line

While millennials are a hot topic in all kinds of banking strategy meetings, Gallup’s research shows that baby boomers, because of their sheer numbers, are still the largest and arguably the most influential generation because of its strongest purchasing power with regard to various banking businesses, such as retail, wealth management, and even business banking.

Given boomers’ significant purchasing power, banks’ failure to earn this large demographic’s trust and satisfaction may be costing them money. Fully engaged customers are banks’ most valuable customers because they are emotionally attached and rationally loyal, while actively disengaged customers are emotionally detached and antagonized, and seek out opportunities to talk to others about their negative experiences. The 2013 retail banking study shows that 12% of banking baby boomers are actively disengaged with their primary bank. If banks can convert their actively disengaged customers to fully engaged customers, Gallup research shows it could open up a market of at least $82 billion in deposits and $443 billion in investable assets in the U.S.

Banks need to design and sell financial products and services for baby boomers that are based on their life cycle needs and economic situations — for example, they might want to offer retirement planning products and advice, organize platforms for baby boomers to learn new tech apps, or help with choosing a health insurance product or wealth transfer planning.

At the same time, similar to customers in all other generations, baby boomers deeply appreciate individualized, customized service. Because baby boomers are such a large, diverse group, their banking needs can vary significantly. Each customer has his or her unique needs, and banks need to be fully aware of differences among individuals.

For results based on the total sample of national adults, the margin of sampling error is ±3 percentage points at the 95% confidence level.

Interviews are conducted with respondents on landline telephones and cellular phones, with interviews conducted in Spanish for respondents who are primarily Spanish-speaking. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by region. Landline telephone numbers are chosen at random among listed telephone numbers. Cellphone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse, and double coverage of landline and cell users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density, and phone status (cellphone only/landline only/both, cellphone mostly, and having an unlisted landline number). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

The 2013 retail banking study results are based on a Web Panel survey, conducted in November 2013, with a sample of 11,809 adults with banking accounts, aged 18 and older, living in all 50 U.S. states and the District of Columbia. The sample of adults with banking accounts was provided by a third-party vendor.

For results based on the total sample of banked adults, the margin of sampling error is ±0.9 percentage points at the 95% confidence level. Data were weighted to match the national population of banked adults on gender, age, and education. In addition, data were also weighted so that each of the top 20 banks, the remaining banks, and credit unions were represented in the data proportional to their share of national deposits.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.

For more details on Gallup’s polling methodology, visit www.gallup.com.

Liked this article? Share it!