26 Apr 2018

Workers in 35 OECD countries pay 25% of their wages in taxes

Paris, (OECD media release), 26/04/2018 – Workers in OECD countries paid just over a quarter of their gross wages in tax on average in 2017, with just over half of countries seeing small increases in the personal average tax rate, according to a new OECD report.

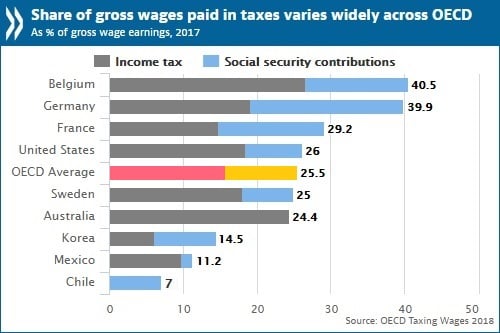

Taxing Wages 2018 shows that the “net personal average tax rate” – income tax and social security contributions paid by employees, minus any family benefits received, as a share of gross wages – was 25.5% across the OECD. This OECD-wide average rate, calculated for a single person with no children earning an average wage, has remained stable in recent years, but it covers country averages that range from below 15% in Chile, Korea and Mexico to over 35% in Belgium, Denmark and Germany.

Increases in the average personal tax rate in 20 of the OECD’s 35 member countries in 2017 were mainly due to wage increases that reduced the impact of tax-free allowances and credits. Average tax rates fell in 13 countries and were unchanged in two (Chile and Hungary). The biggest increases in the tax rate were in the Czech Republic (0.5 percentage points),

Turkey (0.5 percentage points) and Mexico (0.4 percentage points), and the largest decreases were in Luxembourg (-2.0 percentage points), Finland (-0.6 percentage points) and Iceland (-0.5 percentage points). [See Table 6.2c in the report.]

The 2018 edition of Taxing Wages also looks at how tax systems affect the disposable income of households with children. It finds that almost all OECD countries provide a reduced personal average tax rate for households with children relative to households at the same income level without children. This is due primarily to the provision of cash transfers to parents.

On average, a one-earner married couple on an average wage with two children pays 14% of gross wages in taxes, due to reduced personal income taxes and cash benefits. The gap is even wider for lower income households. For example, looking at single workers earning 67% of the average wage, a worker without children pays 21.3% of their wages in taxes, whereas a worker with children pays only 1.8%, on average. On the whole, the size of the fiscal benefit for families with children has increased since 2000, and this is especially the case for single workers with children, whose tax rates are often negative.

“This easing of the income tax burden on families with children, especially on single parents, is encouraging,” said Pascal Saint-Amans, Director of the OECD’s Centre for Tax Policy and Administration. “Setting tax policy in a way that maintains work incentives, particularly for low and middle-income earners, is vital to spur inclusive growth.”

If taxes and costs paid by employers are also considered, Taxing Wages 2018 finds that overall taxes on labour costs decreased on the average worker for the fourth consecutive year in 2017, due to lower employer social security contributions.

This so-called ‘tax wedge’ – total taxes on labour costs paid by employees and employers, minus family benefits, as a percentage of the labour cost to the employer – fell by 0.13 percentage points to stand at 35.9% of labour costs for the OECD area. The decline – largely due to big reductions in Finland, Hungary and Luxembourg – continues a decreasing trend since 2012 that partially reverses the increases that had been observed in the years immediately after the global economic crisis.

Key findings

Net personal average tax rates (NPATR) for single people and families

- In 2017, the highest average NPATR for single workers with no children earning the average wage were in Belgium (40.5%), Germany (39.9%) and Denmark (35.8%). The lowest were in Chile (7%), Mexico (11.2%) and Korea (14.5%). The OECD average was stable at 25.5%.

- The average NPATR for one-earner families with children was 14.0% in 2017.

- The highest NPATRs for one-earner families with two children at the average wage were in Turkey (25.9) and Denmark (25.3%). The lowest NPATRs were in the Czech Republic (0.7%), Canada and Ireland (both 1.2%). The NPATR was negative for Poland (-4.8%) as cash benefits exceeded taxes and social contributions.

- The NPATR for one-earner families with two children rose in 25 countries in 2017, decreased in nine and was unchanged in Chile. The largest rises were in Ireland (2.88 percentage points (p.p.)) and Australia (2.90 p.p.). The largest falls were in Luxembourg (1.03 p.p.) and Poland (5.06 p.p.). The OECD average rose by 0.23 percentage points.

Tax wedges for single people and families with children

- The decline in the OECD area tax wedge in 2017 was largely due to big reductions in Finland, Hungary and Luxembourg. The average tax wedge fell in 16 countries and rose in 19 countries.

- In 2017, the highest average tax wedges for single workers with no children earning the average national wage were in Belgium (53.7%), Germany (49.7%), Italy (47.7%), France (47.6%) and Austria (47.4%). The lowest were in Chile (7%), New Zealand (18.1%) and Mexico (20.4%). The OECD average decreased 0.13 percentage points to 35.9%.

- The average tax wedge for a one-earner family with children in 2017 was 26.1%.

- The highest tax wedge for one-earner families with two children at the average wage in 2017 was in France (39.4). Belgium, Finland, Greece, Italy and Sweden were between 38% and 39%. For this family type, New Zealand had the lowest tax wedge (6.4%), followed by Chile (7.0%) and Switzerland (9.1%).

- The largest increases in the tax wedge for this family type in 2017 were in Australia (2.74 percentage points), Ireland (2.60 p.p.) and Latvia (1.06 p.p.). The largest decreases were in Poland (4.35 p.p.) and Hungary (3.05 p.p.).

- The tax wedge for one-earner families with children is lower than for single people without children in all OECD countries except Chile and Mexico, where tax levels are the same for both. The gap is over 15% of labour costs in Belgium, Canada, the Czech Republic, Germany, Hungary, Ireland, Luxembourg and Slovenia.

Download Taxing Wages 2018: http://webexchanges.oecdcode.org/vpfhmzgA/2318171e.pdf

Further information and individual country notes: www.oecd.org/tax/taxing-wages-20725124.htm