6 Jan 2025

Warning signs emerge as Thai visitor arrivals fail to hit 2019 “normalcy” level

Bangkok – Preliminary visitor arrivals stats for 2024 show that Thailand ended the year below expectations. In fact, they are fraught with early-warning danger signs about the future growth prospects of Thai tourism in a rapidly changing and highly unstable operating environment, locally, regionally and globally.

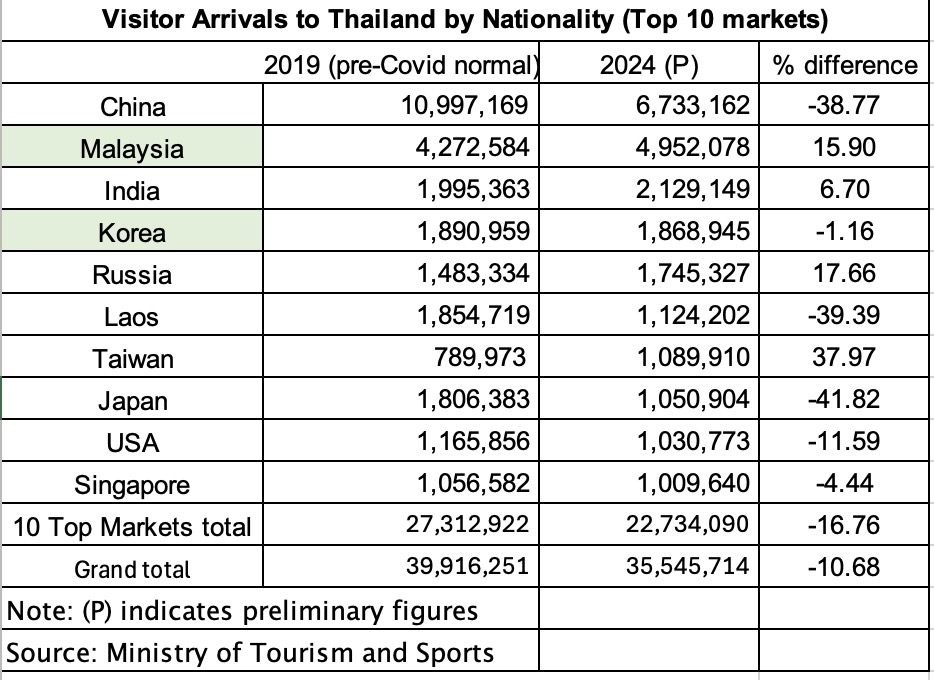

The preliminary stats show that Thailand ended 2024 with 35,545,714 arrivals. Although that is being spun as a positive result, being up 26.27% over the 28,150,016 arrivals in 2023, a closer look shows that it is still 10.68% lower than arrivals in 2019, the pre-Covid year seen as a benchmark for “normalcy.”

In fact, the 2024 arrivals are about the same as the 35,591,978 arrivals in 2017.

Due to the underperformance of key mass-market countries such as China, Japan and Korea, arrivals from the Top Ten markets were 16.76% lower than in 2019. These Top Ten markets generated 68.4% of the total arrivals in 2019, which dropped to 63.9% of the total in 2024.

By contrast, according to the UNWTO, global visitor arrivals were heading for a full recovery in 2024. In the Jan-Sept period, they had reached 98% of the 2019 figures. That indicates Thailand’s performance was much lower than the global norm.

The reasons for this will have to be carefully analysed, but both internal and external factors have played a role. Yes, there is a lot of global uncertainty, but having three tourism ministers in the span of 18 months has clearly not helped. Nor has the infighting amongst the private sector for control of apex bodies such as the Tourism Council of Thailand.

There are warning signs amongst the source-markets, too.

(+) Arrivals from the largest mass-market country, China, are 38.77% lower than the 2019 figures.

(+) So, too, are arrivals from the two other mass-market Northeast Asian countries, Korea and Japan.

(+) Two ASEAN countries, Singapore and Laos, are both lower than the 2019 figures.

On the positive front, four of the Top Ten markets reported growth.

Malaysia was up strongly and will remain the best border crossing-market, albeit with a low average length of stay. This shows the importance of ensuring that the southern border provinces remain at peace.

(+) Russia, inspite of its ongoing war with Ukraine, is still doing remarkably well.

(+) Indian arrivals are rising rapidly and will show considerable promise as connectivity increases.

Clear warning signs are emerging of a potential slowdown in the years ahead.

(+) Tourism is facing an era of over-competition. Global geopolitical and economic uncertainty are forcing significant changes in travel patterns. Many countries are turning to tourism to prop up their economies via the same visa-relaxation, product-diversification and creative-marketing strategies as Thailand. The choice of competitive destinations is at an all time high.

(+) As these new destinations emerge, there is a strong possibility of “Thailand Fatigue” setting in amongst the mass-market source countries. Are they overdosing on exposure to Thailand?

(+) How much negative publicity is being generated about some of our long-standing problems such as frauds, scams, rip-offs? Is this being monitored? What role is such word-of-chats playing in dissuading people from coming to Thailand?

(+) Is Thai tourism again becoming a victim of its own hubris? Tourism industry forums still seem to be focussed only on ChatGPT, climate change and sustainability and the latest campaign, the Amazing Thailand Grand Tourism and Sports Year. There is very little discussion about the real issues facing visitors at the grassroots, and what to do about them.

Future Prospects

As the full figures for 2024 for all markets are released in a few weeks, more insights will emerge about prevailing trends. But there are clear signs that Thailand is reaching a saturation point in attracting visitors from many countries, and will have to seriously rejig its entire future gameplan.

Some possible options:

(+) Marketing in the ASEAN region has been imbalanced, especially countries such as Indonesia and the Philippines. Arrivals from Vietnam are also treading water. This will need to be rectified.

(+) New emerging markets will be the New Frontier, especially those where Thailand still enjoys a positive brand image. The new online visa application process set up by the Ministry of Foreign Affairs will make it easier to tap visitors from secondary cities in existing markets as well as new markets in Africa and Latin America. Low-hanging-fruit source-markets include Bangladesh and Pakistan, both medium-haul markets with good aviation linkages.

(+) The traditional means of monitoring performance by number of visitors and expenditure patterns are losing validity. The key stats to watch are the average length of stay and repeat traffic.

(+) Finally, the future of Thai tourism industry depends entirely on the next external shock. Even the slightest disruption or conflict locally or abroad could send the figures spiralling downwards again.

The Tourism Authority of Thailand has set a target of 40 million arrivals for this year. That is the same as actual arrivals for 2019. If the target is met, it will mean that Thailand has taken six years to return to “normal.”