5 Dec, 2013

No easy death: Ageing populations will need to work longer, save more – OECD report

Paris, (OECD News release) 26/11/2013 – Recent reforms of pension systems have helped to contain the rise in future costs resulting from ageing populations and increasing life expectancy. Governments now need to do more to encourage people to work longer and save more for their retirement to ensure that benefits are adequate enough to maintain standards of living into old-age. Policy action is also needed to avoid rises in inequality among retirees and pensioner poverty, according to a new OECD report.

Pensions at a Glance 2013 says that most OECD countries will have a retirement age for both men and women of at least 67 years by 2050. This represents an increase from current levels of about 3.5 years on average for men and 4.5 years for women. Recent reforms will mean that most workers entering the labour market today will get lower pensions than previous generations and will need to save more for their retirement. Working longer may compensate for some of these reductions but overall each year of contribution will pay out less than today.

“Raising retirement ages and promoting private pensions are all steps in the right direction but alone they are insufficient,” said OECD Secretary-General Angel Gurría. “Governments need to consider the long-term impact on social cohesion, inequality and poverty. Ensuring everyone has a decent standard of living after a life of work should be at the heart of policies.”

Low earners have been largely protected from cuts in most countries and will receive in retirement around 70% of their earnings for a full career. But middle earners will receive on average only around 54% of their earnings upon retirement, facing the risk of a large drop in their living standards. High earners will receive only 48% of their earnings, but they are less vulnerable due to higher personal savings and investments.

Keeping down the costs of running personal and occupational pension schemes is critical. Governments need to urgently address this as part of their efforts to promote private pension systems, says the OECD.

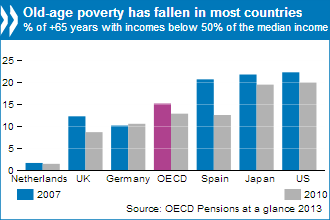

While the balancing act of sustainability and adequacy of pension systems will become starker in the next decades, there are also looming challenges. Pensioner poverty shrank to 12.8% in 2010 from 15.1% in 2007, with falls in 20 countries and rises in only Canada, Poland and Turkey. Actually, children and young people now face higher poverty rates, at 13.4% and 13.8% respectively.

But old-age poverty is likely to be higher in reality, according to the report. Not all pensioners who need last-resort benefits to supplement their income actually claim them, due to stigma or lack of information on entitlements. Further cuts to public services like healthcare could hurt pensioners in particular.

|

In addition to the impact of public services on the adequacy of retirees’ incomes, the report analyses the impact of homeownership and financial wealth. Around 77% of the over-55s are homeowners, compared to 60% of under-45s, although more than one in five elderly homeowners in continental Europe are still paying off their mortgages.

The wealth of retirees is very unequally distributed, within and between countries, which tends to exacerbate inequality in the distribution of retirement income, the report finds. In particular, wide gender wealth gaps exist, with women over 65 particularly affected as they generally live longer, have a lower pension and are at greater risk of poverty when long-term care is needed. So while housing and financial wealth supplement public pension benefits, they cannot be expected to replace a proper pension income.

Pensions at Glance 2013 provides comparative indicators on the national pension systems of the 34 OECD countries, as well as for Argentina, Brazil, China, India, Indonesia, Russian Federation, Saudi Arabia and South Africa. Special chapters provide deeper analysis of recent pension reforms and their impact and of the role of housing, financial wealth and public service for retirement income adequacy.

Country-specific highlights on OECD countries and other highlights of the report are available at www.oecd.org/pensions/pensionsataglance.htm

Click here to read the report online, share, link or embed on your website.

Liked this article? Share it!