31 Oct, 2015

Greatest Fear of Old Age: ‘Who Will Take Care of Me?’ — UBS Investor Watch Report

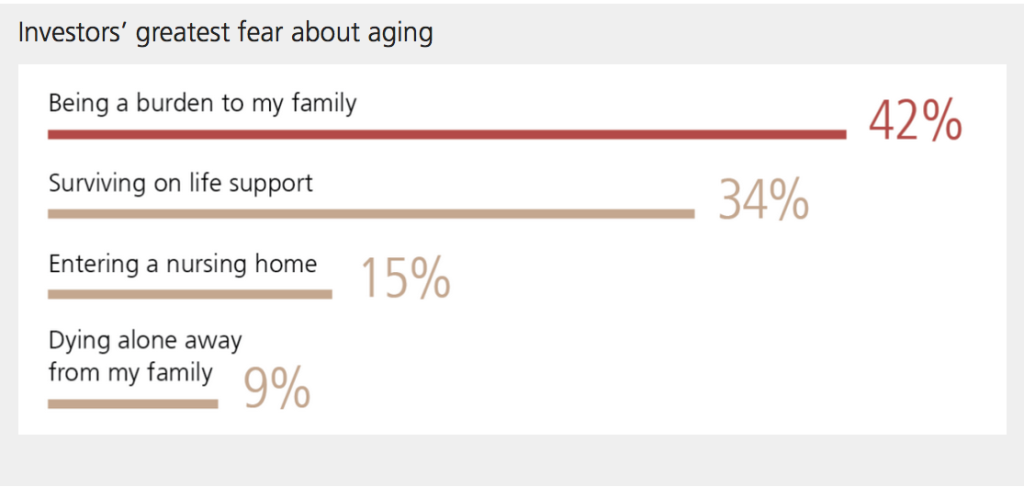

NEW YORK–(BUSINESS WIRE)–– UBS Wealth Management Americas (WMA) today released its quarterly UBS Investor Watch report, “Unassisted Living,” revealing that the greatest fear among wealthy investors as they age is being a burden to children (42%), trumping fears of surviving on life support (34%) or living in a nursing home (15%). Though investors prefer not to seek their children’s assistance, few have discussed their wishes or developed a plan. A mere 39% of investors have talked with children about who will take care of them in old age. Only half (50%) have factored healthcare costs into their overall financial plan, and only 23% have saved for their future care.

|

These findings are startling in light of recent U.S. Census Bureau data predicting that the population of Americans aged 65 and older will grow to greater than 80 million by 2050, and that the number of people likely to require long-term care is expected to more than double from 12 million today to 27 million over that time span.In terms of caring for one’s parents, 47% of respondents who currently provide care described it as a heavy burden, 41% described it as a moderate burden and 12% said it was a minimal burden.

“Maintaining self reliance is important to the vast majority of investors,” said Paula Polito, Client Strategy Officer, UBS Wealth Management Americas. “Having a plan in place for long-term care before they actually need it will help them avoid burdening their children.”

Stark generational differences in caring for the aged

Only a third of wealthy investors (36%) say that they plan to turn to family for support or care, with the vast majority (64%) preferring to solicit outside help. This approach to care stands in stark contrast to what had been the traditional model, when children – naturally – would take on responsibility for the care of aging parents. In fact, three quarters (74%) of wealthy investors say their grandparents relied on family for long-term care, and more than half (57%) said their parents did the same.

The majority of wealthy investors (59%) believe caring for aging relatives is more difficult than it had been in the past. There are several reasons they believe this:

- Longer lifespans: 88% of wealthy investors said long-term care is harder because people are living longer than ever before. As UBS found in the 4Q 2013 Investor Watch report, “80 is the New 60,” the definition of “old” is changing and people are living vibrant lives well into their seventh, eighth and ninth decades.

- Rising costs of care: 76% said they thought the price of modern healthcare is significantly higher than it was for previous generations.

- Geography: Families today are more geographically spread out than they used to be, and the majority of wealthy investors (62%) said they live more than a couple of hours from where they grew up. The same is true for their children – among those who have adult children, a third (33%) said none of their children lives nearby, while only a third (33%) said that all of their children live nearby.

- Complicated care choices: As a result of advances in modern medicine and policy reform, healthcare options have expanded greatly over the years, and 65% of respondents said this has complicated the choices people have to make.

Staying home and outsourcing care

When it comes to preferences on where they want to live and who should take care of them, investors prefer to relieve their children of the responsibility. In terms of housing; 89% would like to stay in their current home, while 54% consider assisted living an appealing option. Only 15% consider their child’s home an appealing option, faring slightly better than the appeal of a nursing home (12%). In terms of care; 80% of investors want their spouse to care for them and 67% want a home health aide, while only 27% want a child to care for them.

Covering future healthcare costs is a priority, but not a certainty, for many

In terms of wealthy investors’ future financial goals, ensuring coverage against health issues and long-term care needs ranks among their top priorities (57% say it is important to them), but fewer than half (48%) say they are confident they will be able to achieve this goal. About half (49%) said they are “highly concerned” about rising healthcare costs, making it one of the more distressing macroeconomic issues for them.

“Even for those who have discussed future health and long-term care decisions, there still is a lot that goes unsaid and unasked between parents and their children,” says Sameer Aurora, Head of Client Strategy for UBS Wealth Management Americas. “It’s a tough conversation, and no one wants to even think about it, let alone talk about it, but it’s important to get everyone on the same page before it’s too late.”

The vast majority of investors are neither planning properly nor seeking out the proper professional opinions – Investor Watch found that 77% have not set funds aside for future medical expenses, and a mere 8% have received advice on managing future healthcare costs. Perhaps because of this, a third of wealthy investors (33%) are worried about medical / long-term care expenses consuming a significant portion of the inheritance they plan to leave children. As expected, those with a plan for long-term care are significantly more confident in their ability to finance care when needed (71% vs. 27% of those without a strategy).

Women are more likely than men to shoulder the responsibility of care

Though Investor Watch found that the overwhelming majority of wealthy investors do not want to be a burden to their families in old age, when they do rely on relatives to fulfill their caregiving needs, 66% say they would rely on a daughter.

This is a role that men and women appear to agree on, with women being more likely than men to acknowledge that they will be their parents’ primary caretakers (29% of women vs. 19% of men), and men being more likely to defer the responsibility to their siblings rather than take it on themselves (26% of men vs. 11% of women). Women say they are willing to become the primary caregiver because they have a closer relationship with their parents (52% of women vs. 41% of men), while men more often say they will take on their parents’ care because they live closer (41% of men vs. 32% of women) or because they have greater financial resources (50% of men vs. 32% of women).

We invite you to read the full report here: www.ubs.com/investorwatch

About UBS Investor Watch

UBS Wealth Management Americas surveys U.S. investors on a quarterly basis to keep a pulse on their needs, goals and concerns. After identifying several emerging trends in the survey data, UBS decided in 2012 to create the UBS Investor Watch to track, analyze and report the sentiments of affluent and high net worth investors.

Methodology

For this 13th edition of UBS Investor Watch, 1,849 affluent and high-net-worth investors responded to our survey from September 10 – 18, 2015. These investors have at least $1 million in investable assets, including 463 with at least $5 million. With 90 survey respondents, we conducted qualitative follow up interviews.

Liked this article? Share it!