6 Apr, 2024

Flagship UN report pinpoints pivotal role of Travel & Tourism in Asia-Pacific economic recovery

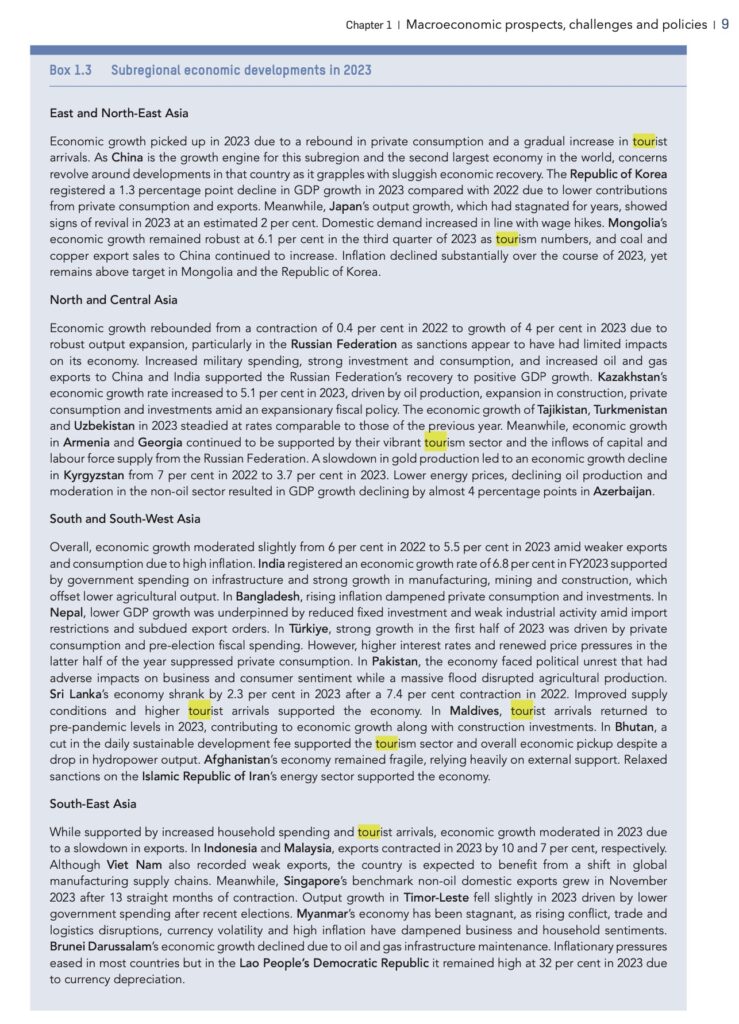

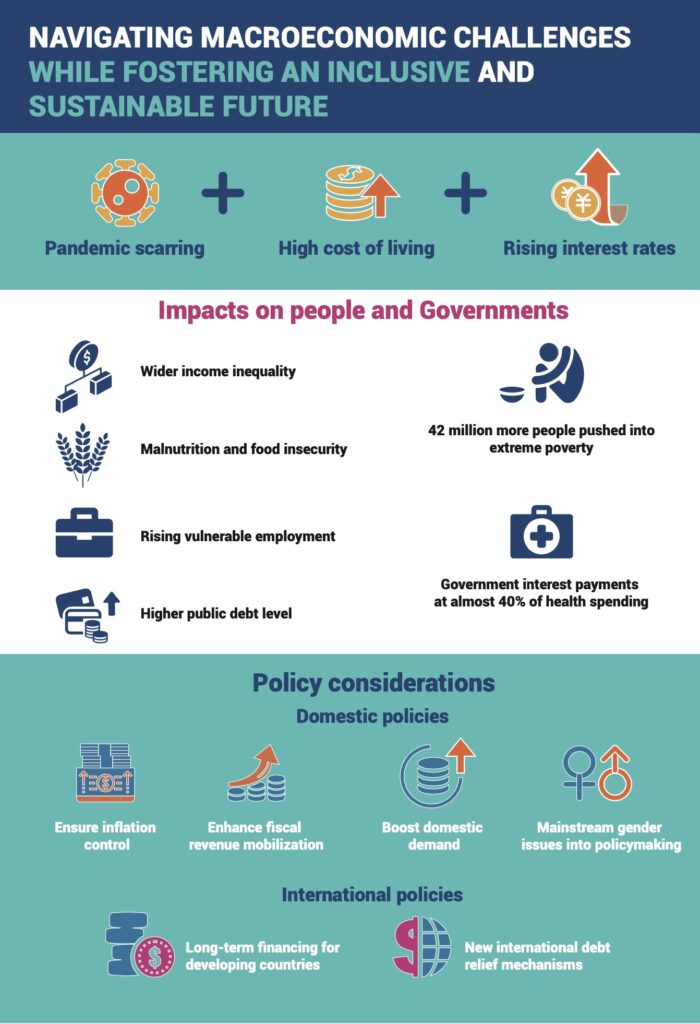

Bangkok — Robust domestic demand and Travel & Tourism are the two major factors contributing to the post-Covid economic recovery of the Asia-Pacific region, according to the flagship annual report of the UN Economic and Social Commission for the Asia-Pacific. Released on 04 April, the report notes that although GDP growth has resumed, multiple risks loom large, such as a staggering debt burden, the Chinese economic slowdown, impact of conflicts in Ukraine and Gaza, and the cost of adjusting to upcoming megatrends such as ageing populations, climate change and technological disruptions.

The key takeaway for the Asia-Pacific tourism industry is that region’s post-Covid economic situation is still fragile. Travel & Tourism can be a major part of the solution but only in the absence of further external shocks. This takeaway elevates the crucial significance of Thai Prime Minister Srettha Thavisin’s Ignite Thailand Vision strategy and underscores the importance of preserving and protecting peace and stability across the entire operating environment — social, economic, geopolitical as well as local, regional and global.

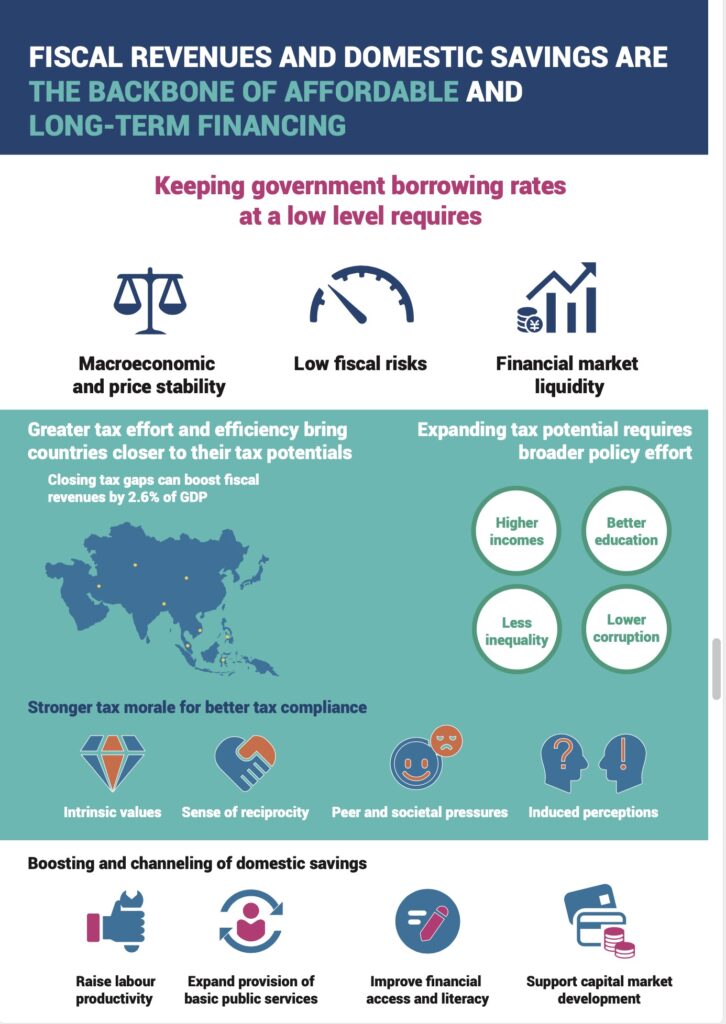

Indeed, a close analysis shows that a reinvigorated Travel & Tourism sector can expedite the recovery by helping alleviate national debt burdens, broadening the tax base, mobilising savings, creating jobs for women and senior citizens, addressing climate change and facilitating digital transformation. It opens a clear window of opportunity to examine the entire taxation structure of Travel & Tourism, a hugely cash-rich industry, especially the multinational corporations and booking engines.

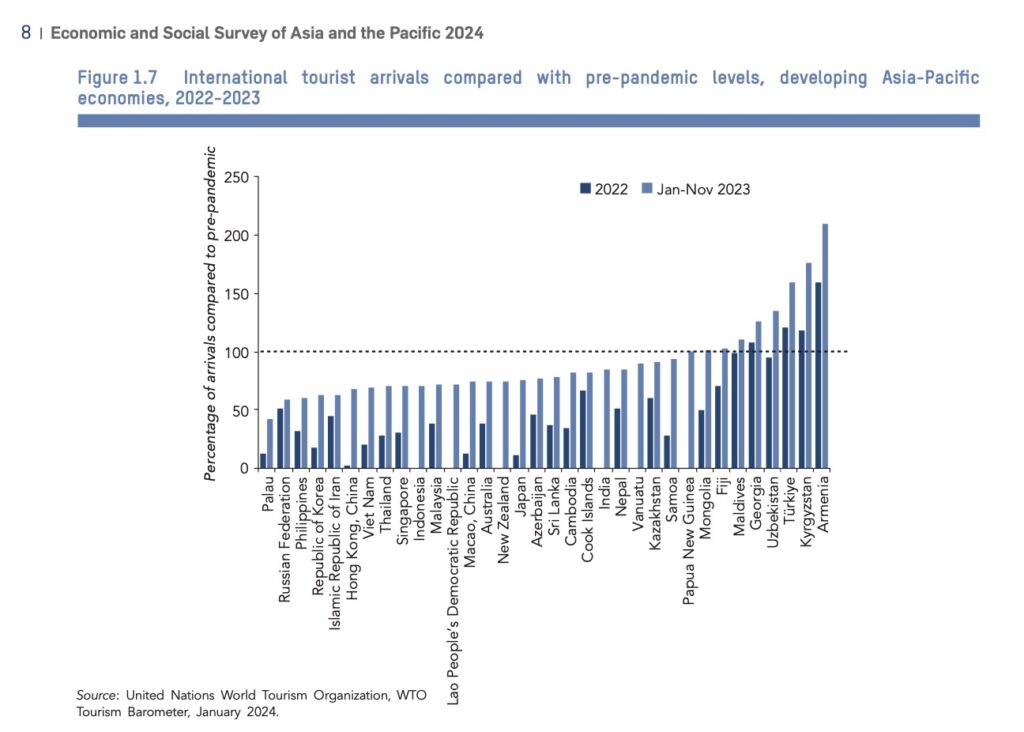

Says the report, “Global services trade particularly in tourism has seen an uptick with the continuing recovery from pandemic restrictions on travel. Tourism recovery strengthened in 2023 with arrivals in the Asia-Pacific region rising on average to about 62 per cent of pre-pandemic levels. Tourist arrivals have climbed back to pre-pandemic levels in Armenia, Fiji, Georgia, Kyrgyzstan, Maldives, Türkiye and Uzbekistan. In tourism-dependent countries in South-East Asia, the return of arrivals has reached approximately 70 per cent of pre-pandemic level. In the Pacific, tourism has been a key driver of GDP growth, particularly for Cook Islands, Fiji, Palau and Samoa.”

Addressing the launch at the Foreign Correspondents Club of Thailand, UNESCAP Executive Secretary Ms Armida Salsiah Alisjahbana said: The 2024 edition of the Economic and Social Survey of Asia and the Pacific depicts a mixed picture of the region’s economic landscape. While there has been an upturn in the average economic growth rate in 2023 and projected steady growth for 2024 and 2025, showcasing the region’s robust economic resilience, the rebound was uneven, limited to a few large economies. High inflation and interest rates, coupled with weak external demand and heightened geopolitical uncertainty, are casting shadows over near-term economic prospects. Moreover, despite the appearance of relatively steady economic growth, there are underlying issues, such as subdued job creation, weakened purchasing power and increased poverty and socioeconomic inequalities across the region.”

A core focus of this year’s report is the cost of borrowing and debt maturity that weighing down on Asia Pacific economies due to the debt burden created by the Covid-19 crisis. ESCAP executives shared the following info:

Total external debt stocks in developing Asia-Pacific in 2022 totaled $5.4 trillion (Based on World Bank, WDI, accessed April 2024).

Total public external debt stocks in developing Asia-Pacific in 2022 amounted to $1.7 trillion (Based on World Bank, WDI, accessed April 2024).

Total public debt for developing Asia-Pacific amounted to $17.3 trillion in 2022 and is estimated at $20.5 trillion in 2023. (Based on IMF, Fiscal Monitor, October 2023).

Says UN Secretary General Antonio Gueterres in a powerful introduction to the report, “Governments of developing countries across Asia and the Pacific are victims of an unjust, outdated and dysfunctional global financial architecture. They face fiscal constraints, rising borrowing rates with shorter loan maturity, and heavy debt burdens. Up to half of low-income countries in the region are already in, or at high risk of, debt distress, forced to choose between servicing debt or investing in education, health and social protection for their people.”

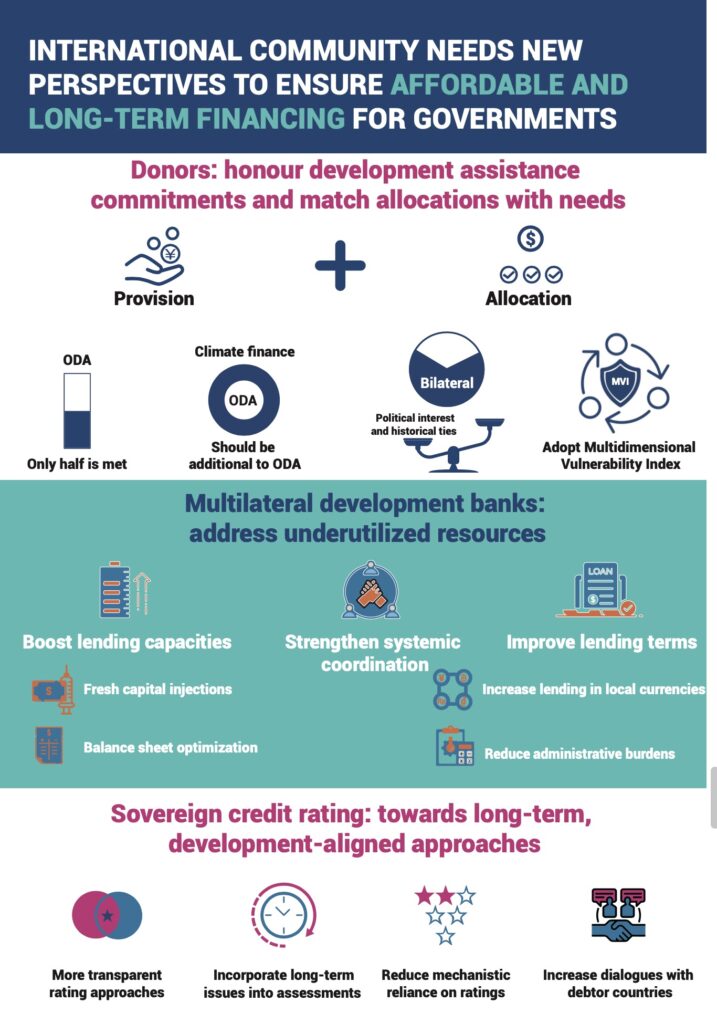

To address this, the report recommends a three-pronged approach:

1. Donors should honour their overdue commitments and match allocations with needs: Official development assistance in 2022 amounted to only half of the commitment made since 1970. This assistance should be provided to developing countries with wider development financing gaps and greater exposure to shocks, rather those with shared political interests.

2. Addressing underutilized resources and capacities of multilateral development banks: Fresh capital injections for multilateral development banks are urgently needed to catch up with the growing development needs of developing countries. In the meantime, the banks can better leverage their existing capital, increase lending in local currencies, reduce the administrative burden of loan packages and work closely with each other to amplify their collective lending capacities.

3. Towards more development-aligned and long-term sovereign credit ratings: Credit rating agencies should incorporate the potential long-term impacts of demographic shifts and climate risks on sovereign risks in their assessments as well as recognize that public investment in sustainable development raises sovereign creditworthiness over time. Meanwhile, ideas to set up a regional credit rating agency that better understands the development context of Asia and the Pacific could be explored. ESCAP can facilitate experience-sharing in this regard.

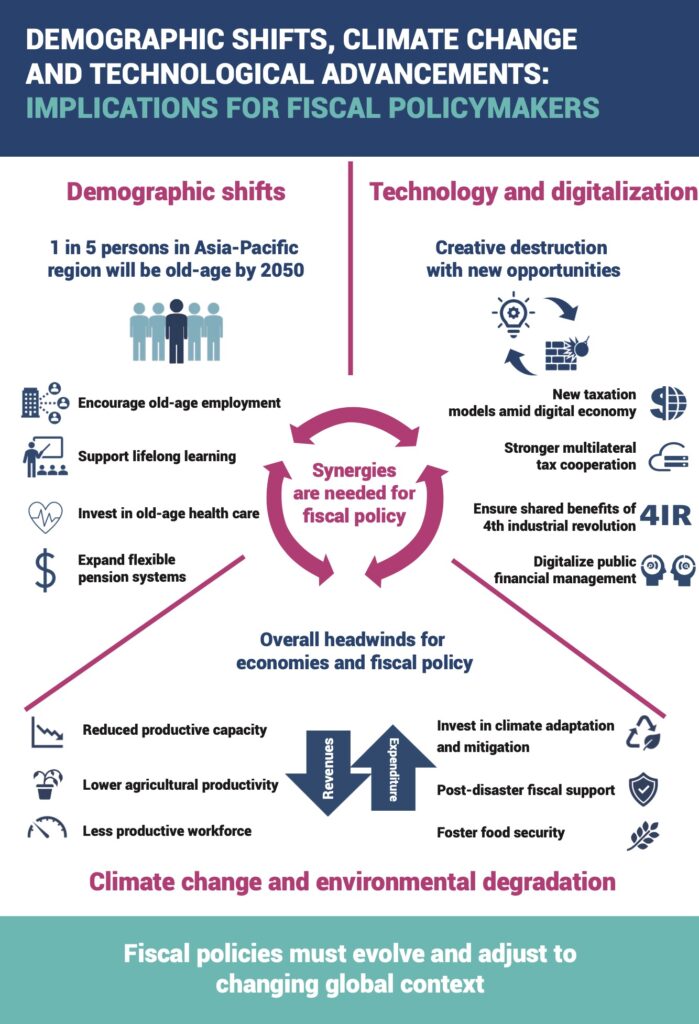

While grappling with this unstable and fluid scenario, the report flags three megatrends which are reshaping economies, directly influencing fiscal resources and fiscal policy conduct, and presenting both risks and opportunities.

1. Population ageing: A shrinking workforce and lower labour productivity among older workers could hamper tax collection. Fiscal needs for old-age health care, social protection and lifelong learning will rise. Fiscal policy could also become less effective, as consumption by older people is less responsive to fiscal incentives.

2. Climate change and environmental degradation: Fiscal revenues would be eroded due to weaker productive capacity amid natural resource scarcity and less productive workers. Sizeable fiscal spending will be needed to rebuild post-disaster economies and invest in green development. Climate change can push up inflation, thus interest rates and government borrowing costs, through lower crop yields and removal of fossil fuel subsidies.

3. Technologies and digitalization pose both risks and opportunities: Countries with traditional tax systems based on the tangibility and physical location of goods and services find it difficult to tax the increasingly digitalized economies. However, digital tools can also help enhance the efficiency and effectiveness of public financial management systems, such as electronic procurement and filing of tax returns.

The bottomline is that Covid-19 may be over but many new dangers are on the horizon, and getting worse. The Asia-Pacific, the world’s most populous region, needs at least 10 years of peace and stability to maintain the recovery. Steering clear of internal conflict and shielding itself from the fallout of external conflicts, is critical to the growth which could otherwise hit the skids in a split second.

The ESCAP report provides a comprehensive fiscal checklist against which Travel & Tourism strategies can be created and adapted to strengthen the overall recovery, especially in many of the tourism-dependent countries. It is also a very useful point of reference for regional tourism organisations such as PATA, ASEANTA and the tourism units of subregional bodies such as BIMST-EC, the GMS and IMT-GT to bolster intra-regional travel.

Click here for more information and downloads …

Here are key infographics:

Liked this article? Share it!