3 Dec 2024

No Hope for Global Peace as “Merchants of Death”, Mostly American, Rake in Billions

Bangkok – The Stockholm International Peace Research Institute (SIPRI), the world’s leading think-tank tracking global military expenditure, on 02 December released new data on revenues earned by the 100 largest companies dealing in weaponry and military services. What’s that got to do with Travel & Tourism? Everything.

The shocking statistics and trends unveiled in the report show clearly that global wars and conflict, led by the ongoing hot wars in Ukraine and the Middle East, plus simmering tensions in Asia, have now become a mainstream business, an economic driver, job creator and generator of corporate shareholder value. They all but guarantee that there will be no global peace for at least another decade.

Consider the implications for the future of Travel & Tourism, the so-called “Industry of Peace.”

Here are some keypoints of the report, for the benefit of tourism policy- and decision-makers who have the sense to recognise the looming risks and threats, and the wisdom to start asking relevant questions (such as those which follow later in this post).

(+) Revenues earned by the 100 largest companies selling weapons and military services reached $632 billion in 2023, a real-terms increase of 4.2% compared with 2022. Arms revenue increases were seen in all regions, with particularly sharp rises among companies based in Russia, Israel, Korea and Japan. Note that this figure only covers the Top 100 companies. If more companies are added, the figure would be vastly higher.

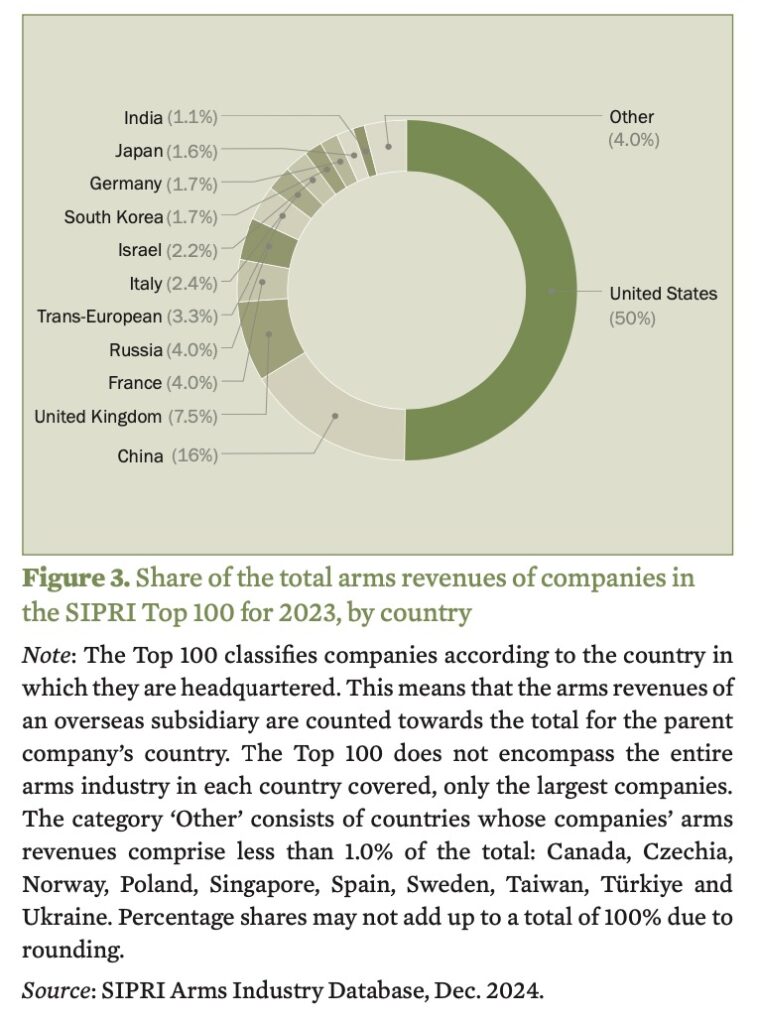

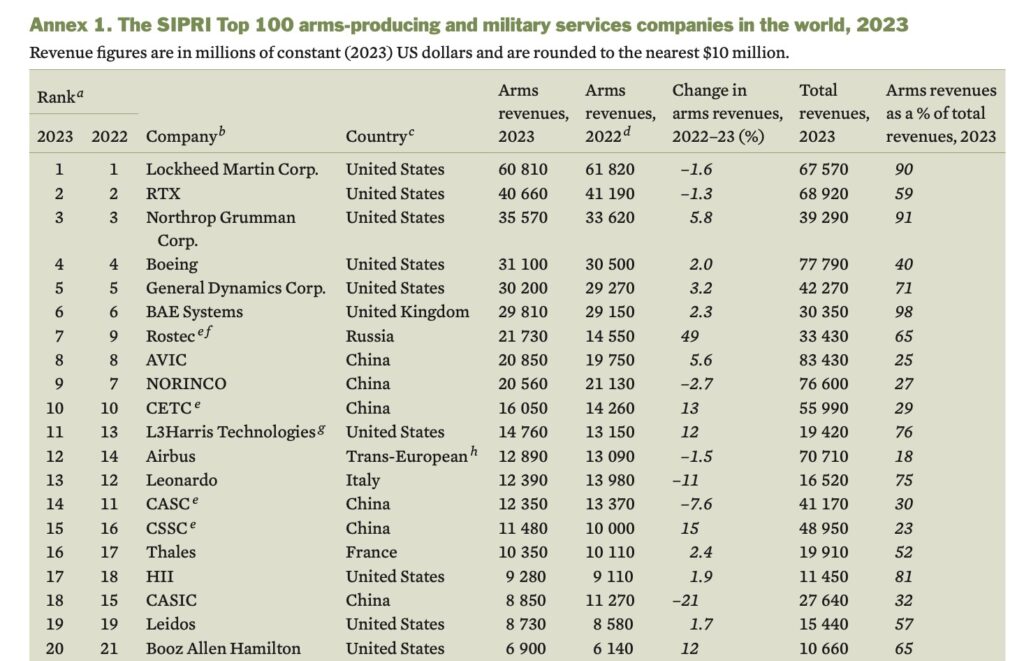

(+) U.S.-based companies are the biggest beneficiaries, comprising 41 of the companies in the Top 100. They recorded arms revenues of $317 billion, half the total arms revenues of the Top 100 and 2.5% more than in 2022. Since 2018, the top five companies in the Top 100 have all been based in the USA.

(+) The figures for 2024 are expected to be even higher, thanks to the intensified conflicts. According to Lorenzo Scarazzato, a Researcher with the SIPRI Military Expenditure and Arms Production Programme, “The arms revenues of the Top 100 arms producers still did not fully reflect the scale of demand, and many companies have launched recruitment drives, suggesting they are optimistic about future sales.”

(+) Large companies like Lockheed Martin and RTX (formerly Raytheon) recorded a drop in revenues, not due to lower demand but because their range of products includes aeronautics and missiles which often depend on complex, multi-tiered supply chains, making them more vulnerable to supply chain challenges in 2023, according to Dr Nan Tian, Director of SIPRI’s Military Expenditure and Arms Production Programme.

(+) The combined arms revenues of the 27 Top 100 companies based in Europe (excluding Russia) totalled $133 billion in 2023. This was only 0.2% more than in 2022, the smallest increase in any world region. However, the SIPRI data pointed out, European arms companies produce complex weapon systems which have longer lead times. As a result, they were mostly working on older contracts during 2023 and their revenues for 2023 do not reflect the influx of orders.

(+) Demand linked to the war in Ukraine has benefitted companies in Germany, Sweden, Ukraine, Poland, Norway and Czechia, particularly for ammunition, artillery and air defence and land systems. For instance, Germany’s Rheinmetall increased production capacity of 155-mm ammunition and its revenues were boosted by deliveries of its Leopard tanks and new orders, including through war-related ‘ring-exchange’ programmes (under which countries supply military goods to Ukraine and receive replacements from allies).

(+) The two Russian companies listed in the Top 100 saw their revenues increase by 40% to reach an estimated $25.5 billion. This was almost entirely due to the 49% increase recorded by Rostec, a state-owned holding company controlling many arms producers, including seven previously listed in the Top 100 for which individual revenue data could not be obtained. The SIPRI report admits that the actual figures are much higher and the continued Russian offensive in Ukraine has required increased production of combat aircraft, helicopters, UAVs, tanks, munitions and missiles.

(+) 23 companies in the Top 100 are based in Asia and Oceania. They recorded 5.7% revenue growth, to reach $136 billion. Four South Korea-based companies recorded a combined 39% increase to reach $11.0 billion. Five Japanese companies rose by 35% to $10.0 billion. A policy of military build-up in Japan since 2022 drove a flurry of domestic orders, with some companies seeing the value of new orders increase more than 300%. South Korean firms are also trying to expand their share of the global arms market, including demand in Europe related to the war in Ukraine.

(+) Six of the Top 100 arms companies were based in the Middle East. Their combined arms revenues grew by 18% to $19.6 billion. Due to the war in Gaza, revenues of the three companies based in Israel in the Top 100 reached $13.6 billion. This was the highest figure ever recorded by Israeli companies in the SIPRI Top 100. Israeli arms producers are booking many more orders as the war in Gaza rages on and spreads. The three companies based in Türkiye saw their arms revenues grow by 24% to $6.0 billion, benefiting from exports prompted by the war in Ukraine and from the Turkish government’s continued push towards self-reliance in arms production.

Other notable developments

(+) The nine companies in the Top 100 based in China saw their smallest year-on-year percentage increase in arms revenues (+0.7%) since 2019 amid a slowing economy. Their total arms revenues in 2023 reached $103 billion.

(+) The combined arms revenues of the three Indian companies in the Top 100 increased to $6.7 billion (+5.8%).

(+) NCSIST, the only Taiwan-based company in the Top 100, recorded a 27% increase in its arms revenues to $3.2 billion.

(+) Türkiye’s Baykar produces armed uncrewed aerial vehicles (UAVs) that have been widely used in the war in Ukraine. Exports accounted for around 90% of its arms revenues in 2023, which increased by 25% over the year to $1.9 billion.

(+) The United Kingdom’s Atomic Weapons Establishment, which designs, manufactures and maintains nuclear warheads, recorded the largest year-on-year percentage increase in arms revenues (+16%) among UK companies in the Top 100, to reach $2.2 billion.

Points to Ponder for the Travel & Tourism industry

(+) The SIPRI data highlights only bottom-line revenues. But what is the ripple-effect impact? How many jobs does the Arms Bazaar create? What is the contribution to global GDP and GNP? How does it drive shareholder value and stock prices?

(+) What is the environmental impact? The increasing sophistication of the weaponry relies heavily on rare-earth metals and minerals Where are those being mined? What is the environmental impact on the battlefields, training grounds and the aftermath?

(+) What is the health and medical impact of wars? How much does it cost countries to take care of those physically and mentally disabled? What is the loss in productivity for national economies?

(+) What is the nexus between arms dealers and global politicians? How much do arms dealers contribute to political campaigns, corruption and other forms of social, political and economic unrest?

(+) How does all this equipment and technology seek out additional sources of revenue in the civilian sector, specifically to boost “safety and security” in cities, communities, office buildings, transportation systems, etc? What is the value of that? Who pays?

(+) The arms dealers are only the sellers and manufacturers. What about the buyers? How many billions are expended for military budgets to pay for the hardware as well as supporting software, such as salaries, retirement pensions, perks, etc?

(+) To place those billions in context, what is the global budget of the United Nations? How do the earnings of the arms dealers compare against the funds desperately needed to pay for the UN Sustainable Development Goals or climate change adaptation and mitigation efforts?

(+) How do those earnings compare against national budgets of many countries? How do they compare against individual budgets for education, health, environment, social services, etc?

(+) How do they compare against Travel & Tourism budgets globally, regionally and nationally?

(+) How does it help create a better, safer, saner, healthier, more just world ? Or is the result exactly the opposite? Who benefits?

(+) When will the Travel & Tourism industry start raising these valid questions in conferences and forums?

(+) As weapons-makers need wars and vice versa, what are the chances of this ever coming to a stop?

More details about the SIPRI Arms Industry Database and its research methodology can be found here.